With Decades of Asia Based Deal

Experience - our Founders Make

Asia Investing Easy For You

With Decades of Asia Based Deal

Experience - our Founders Make

Asia Investing Easy For You

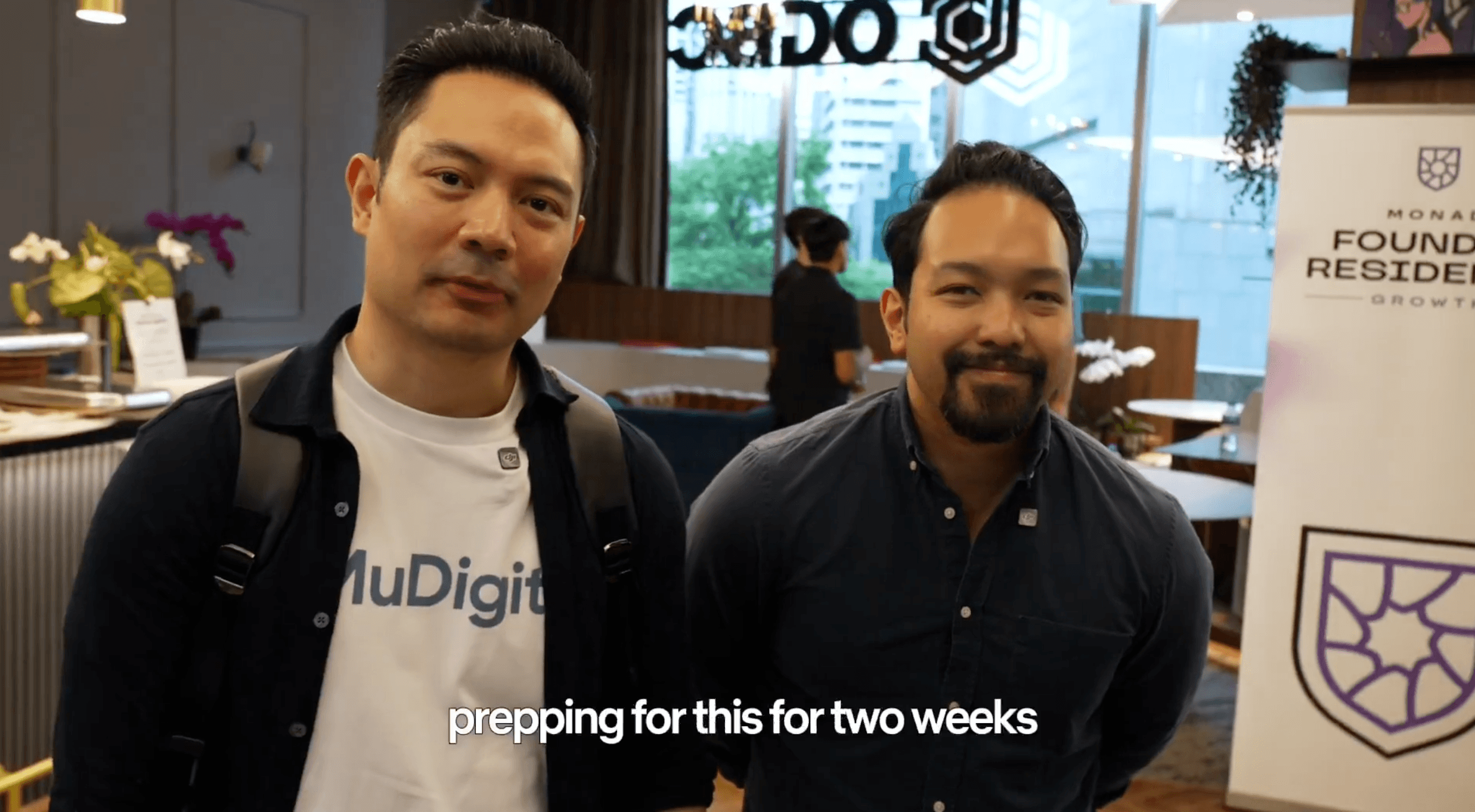

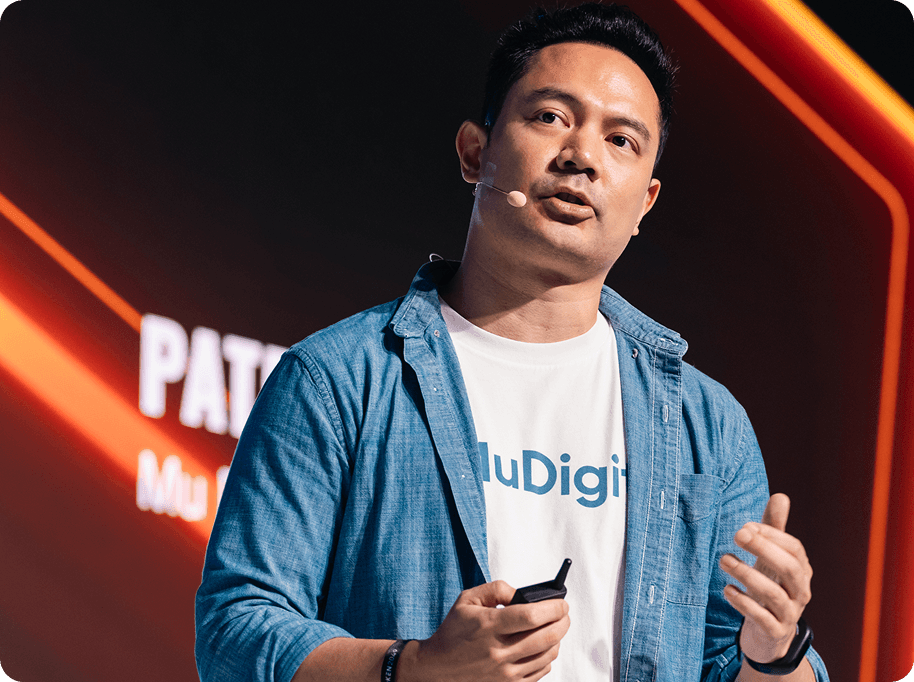

Patrick Hizon | Co-Founder & CEO

The best Asian investments are gate kept to the financial elite. Limited deal flow across borders. High investment minimums. Multiple middle men. Access barriers are stacked against you.

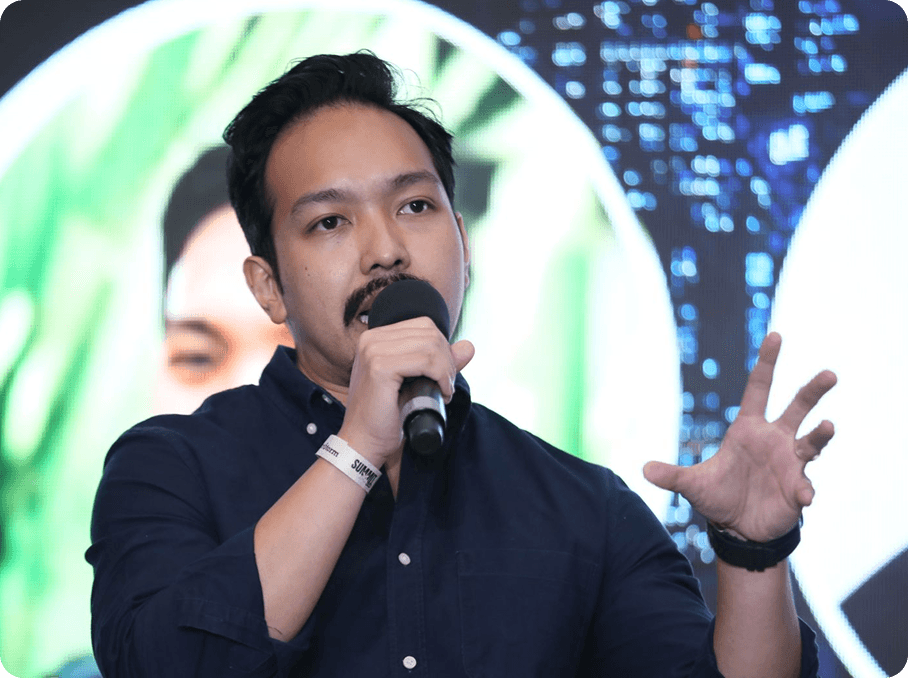

Cholo Maputol | Co-Founder & CCO

Mu Digital allows the every day crypto user access to the most attractive Asian investments. Our products are backed by the entire spectrum of Asia Credit investments: bonds backed by governments, financial institutions and corporations; private credit - co-underwritten with blue chip investment banks and private credit firms. Investing in Asia just became easy.

We simplify the investing process for Asia based deals

We eliminate the complexity of credit portfolio management. You earn passively.

40+ Years of Deal Sourcing Experience Put to Work for You

Both Founders ran desks at global investment banks. We have deep institutional networks across Asia.

Your Investments Will Always Remain Transparent

Clear asset backing. Regular proof of reserves reporting. Smart contract open sourced and audited.

Earn stable yields - whether in the bull or bear market

Our yields do not fluctuate with broader crypto markets. No need to offramp stablecoins through multiple intermediaries in market downturns.

Our Products

Our Products

Earn up to 15% on your stablecoins. Backed by investment grade Asian bonds and proprietary private credit deals.

muBOND

Supercharge your yields. Move at the speed of DeFi. Takes first loss in incidence of credit default.

TVL

$2.82M

APY

15%

Asia Dollar (AZND)

Safe and secure yields. Move at the speed of DeFi. Secured against incidence of credit default in our portfolio.

TVL

$11.02M

APY

7%

Partners Combining Global Reach

with Local Expertise

Partners Combining Global Reach

with Local Expertise

Mu Highlights

Mu Highlights

FAQ

General

Mu Digital brings Asia’s best yields onchain, giving everyday DeFi users access to high-quality Asian sovereign and corporate borrowers traditionally reserved for high net worth individuals and institutions.

The protocol is built by ex-investment bank executives (ex BofA Merrill Lynch, UBS), active in Web3 since 2021, and is backed by UOB (top-3 ASEAN bank) and crypto institutions including CMS Holdings, Signum Capital, and Cointelegraph Accelerator.

Product

Products are backed by:

- Government & corporate bonds

- Proprietary private credit deals

These investments are sourced thru the existing networks of Mu Digital’s Co-Founders, who between them have $200 billion of Asia focused capital markets deal origination experience.

The initial portfolio focuses on investment grade bonds with a credit rating higher than BBB. The choice of an average rating for the backing assets of BBB is deliberate as BBB companies have a historical default rate of <1% in any given 3 year period which partially mitigates the credit risks of lending to non government counterparties.